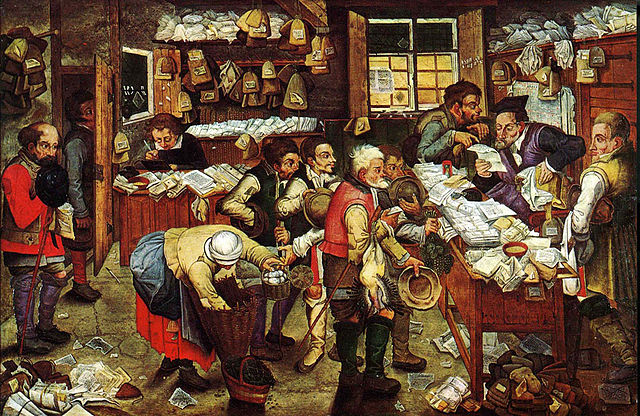

It’s that time of year. The daphne outside our front door perfumes the air. The weather can’t decide if it’s hot or cold. And I spend weekends getting my tax return ready for the accountant.

By now, I’ve got things down to a science. I use a spreadsheet to track income, expenses, and donations. I review the 1099s and online and the paper receipts I’ve collected for the year to fill in earnings and expenses by category, and doublecheck my work against the Quicken data my husband keeps. Then we bundle up everything and send it to the accountant to triple check, format, and send back to us to sign and submit to the IRS. It might not be the most streamlined or modern process, but it works for us.

In 2024, my biggest business expenses were professional services and insurance; communications (internet, cell service, website and domain name fees, etc.); local taxes; and dues and subscriptions. I took the standard home office deduction, and spent zero on travel. All told, business expenses were about 8.5% of my gross income – slightly under average. What other kind of business could you run with an overhead that low? It’s one reason why working as a self-employed writer is so attractive.

If you’re working on your 2024 tax return and need help, here’s advice pulled from the ASJA Confidential archives on figuring out your bottom line, accounting for bad debt (like getting stiffed by a client), and home office deductions. (Click on the title to read the full article.)

Tax Time! Examining Your Bottom Line

Most people look forward to doing their taxes with the enthusiasm normally reserved for the dentist’s office. Yet for writers it’s especially important – especially when considering deductions and other potential benefits for the self-employed.

Tax season also offers an opportunity to examine one’s financial health and future, to determine which clients were rainmakers and which others soaked up your time and talent with little or no return on investment.

For 20-some years, member and former ASJA president Jack El-Hai has successfully followed a basic blueprint for setting his fees. “I got the formula from a website for freelancers,” he says, adding the provision that “there are many other things to think about when accepting an assignment, such as how enjoyable the project might be and potential exposure to new readers and markets.” — Written by Sandra Gurvis, April 4, 2017

No Tax Break If Client Stiffs You

Contrary to what many freelancer writers mistakenly believe, long-standing regulations usually prohibit most of them from claiming bad-debt deductions on their tax returns when they’re unable to recover amounts due from clients.

Why should freelancers forget about any kind of relief when they fill out their tax forms? Because, says the IRS, there are no tax breaks for “cash-basis taxpayers,” agency argot for individuals who weren’t previously required to count those unpaid amounts as reportable income.

The IRS helps ease the hurt only for freelancers who come within the definition of “accrual basis taxpayers,” meaning individuals who were previously required to declare such amounts as income. Below is a representative question that I have frequently received from freelancers. — Written by Julian Block, Sept. 10, 2014

New Simplified Home Office Tax Deduction: Writers, Do the Math!

Any freelance writer who spends hours calculating business use of home expenses for their tax return might shout a fervent “hurrah!” when they hear about the simplified home office tax deduction option. But writer beware – the easy option could cost you dollars.

Starting from the 2013 tax year, writers claiming a home office deduction have two options to work out their deduction:

1) The regular home office deduction method we’ve known and (ahem) loved for years using Form 8829 Expenses for Business Use of Your Home. This requires calculating actual expenses for the percentage of the home used for business. Obviously you need to keep good records to do the math on those expenses and support your deduction.

2) The simplified home office tax deduction, also called the safe-harbor method, does away with recordkeeping, calculator frenzy, and form-filling. Just take the flat-rate deduction of $5 per square foot of the part of the home used for business. This method is capped at a maximum of 300 square feet ($1,500).

Note that the new simplified option does not change the requirements for qualifying for a home office deduction. For example, the space still needs to be used exclusively and regularly as your principal place of business. — Written by Tania Casselle, March 3, 2014

**

Michelle Rafter is a Portland Oregon, ghostwriter specializing in management, people, technology, and workforce issues. She’s ASJA’s publications chair, and helped plan ASJA’s 2023, 2024, and 2025 annual conferences.